Either a rebound or a breakout imminent on Hong Kong 50 Index

Hong Kong 50 Index is heading towards the support line of a Channel Down. If this movement continues, we expect the price of Hong Kong 50 Index to test 28635.0000 within the next 2 days. But don’t be so quick to trade, it has tested this line numerous times in the past, so this movement […]

Either a rebound or a breakout imminent on Hong Kong 50 Index

Hong Kong 50 Index is heading towards the support line of a Channel Down. If this movement continues, we expect the price of Hong Kong 50 Index to test 28635.0000 within the next 2 days. But don’t be so quick to trade, it has tested this line numerous times in the past, so this movement […]

Either a rebound or a breakout imminent on Australia 200 Index

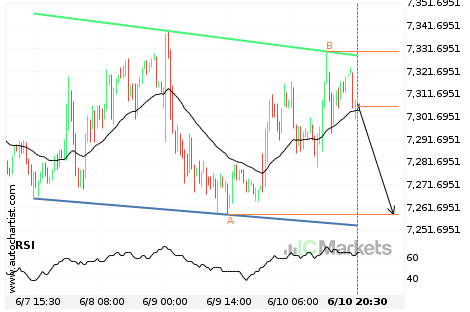

Australia 200 Index is heading towards the support line of a Channel Down. If this movement continues, we expect the price of Australia 200 Index to test 7258.3000 within the next 22 hours. But don’t be so quick to trade, it has tested this line numerous times in the past, so this movement could be […]

Either a rebound or a breakout imminent on Australia 200 Index

Australia 200 Index is heading towards the support line of a Channel Down. If this movement continues, we expect the price of Australia 200 Index to test 7258.3000 within the next 22 hours. But don’t be so quick to trade, it has tested this line numerous times in the past, so this movement could be […]

Either a rebound or a breakout imminent on Hong Kong 50 Index

Hong Kong 50 Index is heading towards the support line of a Triangle. If this movement continues, we expect the price of Hong Kong 50 Index to test 28707.5000 within the next 2 days. But don’t be so quick to trade, it has tested this line numerous times in the past, so this movement could […]

Either a rebound or a breakout imminent on Hong Kong 50 Index

Hong Kong 50 Index is heading towards the support line of a Triangle. If this movement continues, we expect the price of Hong Kong 50 Index to test 28707.5000 within the next 2 days. But don’t be so quick to trade, it has tested this line numerous times in the past, so this movement could […]

Should we expect a bearish trend on Australia 200 Index?

The breakout of Australia 200 Index through the support line of a Rising Wedge could be a sign of the road ahead. If this breakout persists, we expect the price of Australia 200 Index to test 7255.4767 within the next 2 days. One should always be cautious before placing a trade, wait for confirmation of […]

Either a rebound or a breakout imminent on Hong Kong 50 Index

Hong Kong 50 Index is heading towards the support line of a Triangle. If this movement continues, we expect the price of Hong Kong 50 Index to test 28654.7000 within the next 6 hours. But don’t be so quick to trade, it has tested this line numerous times in the past, so this movement could […]

Either a rebound or a breakout imminent on Hong Kong 50 Index

Hong Kong 50 Index is heading towards the support line of a Triangle. If this movement continues, we expect the price of Hong Kong 50 Index to test 28654.7000 within the next 6 hours. But don’t be so quick to trade, it has tested this line numerous times in the past, so this movement could […]

Will Australia 200 Index have enough momentum to break resistance?

Australia 200 Index is heading towards the resistance line of a Rising Wedge and could reach this point within the next 2 days. It has tested this line numerous times in the past, and this time could be no different from the past, ending in a rebound instead of a breakout. If the breakout doesn’t […]